√ダウンロード yield to call formula excel 301627-Excel formula to calculate yield to call

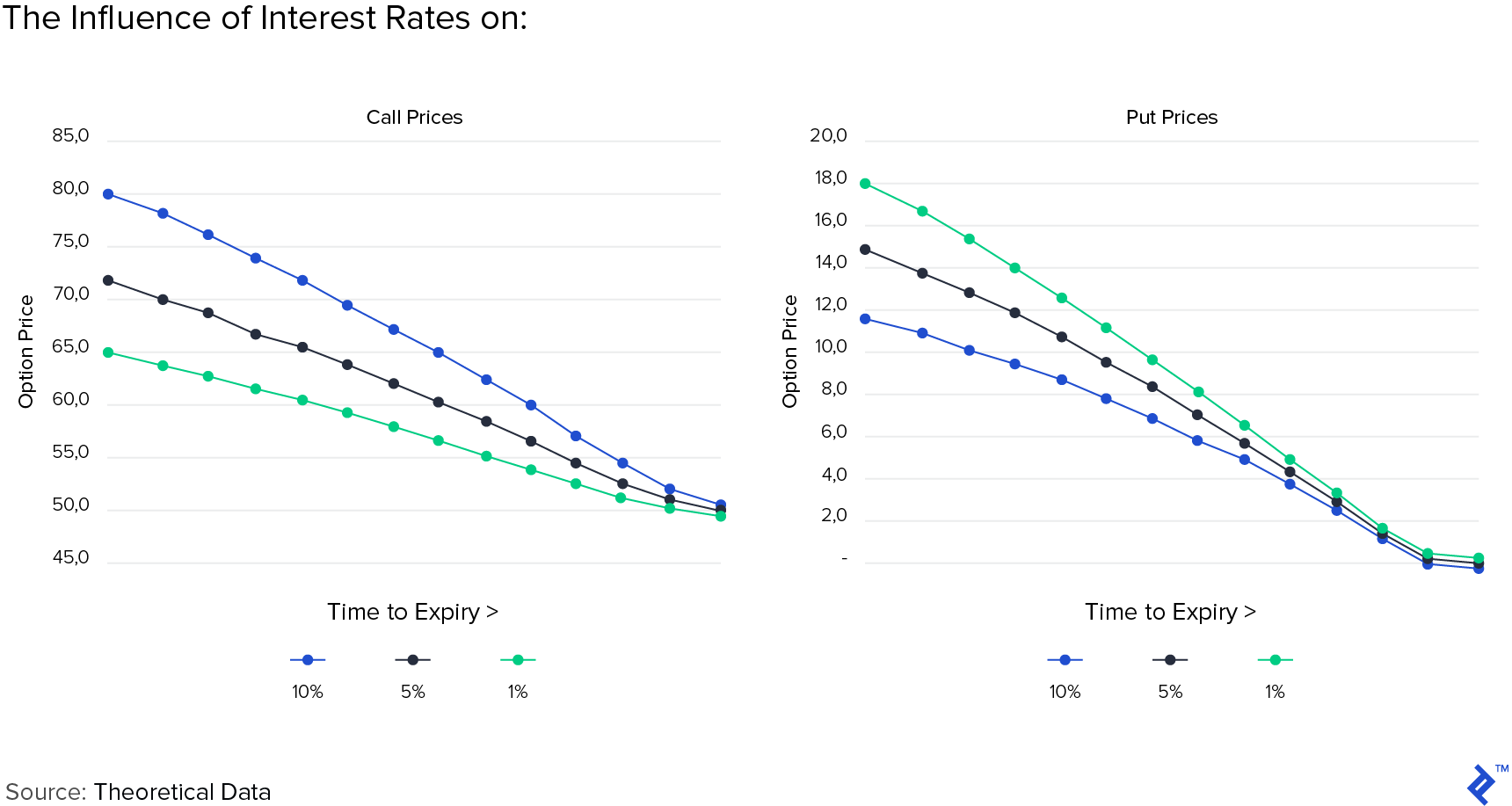

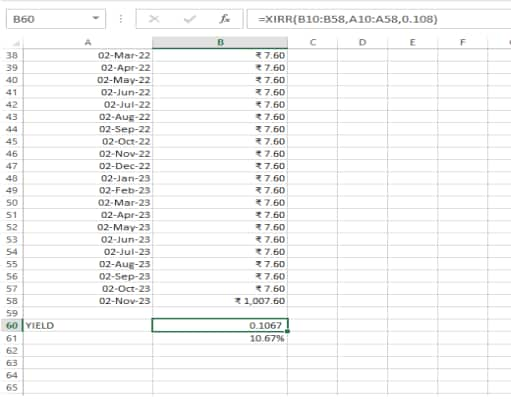

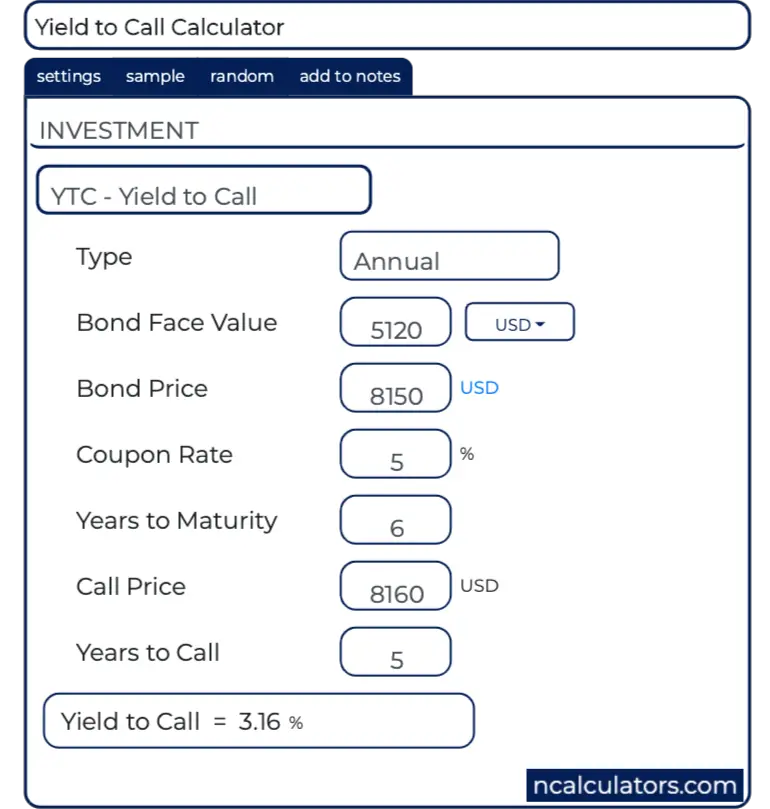

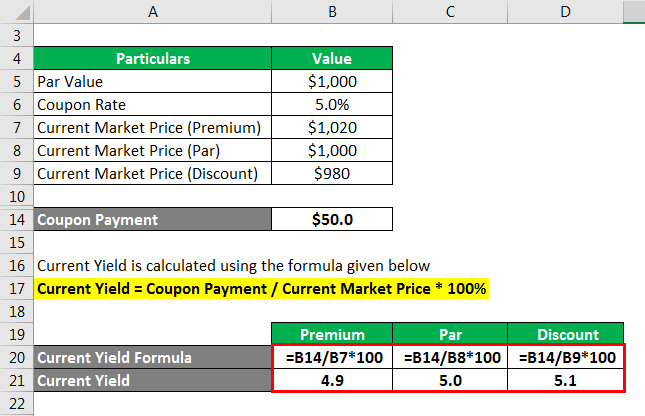

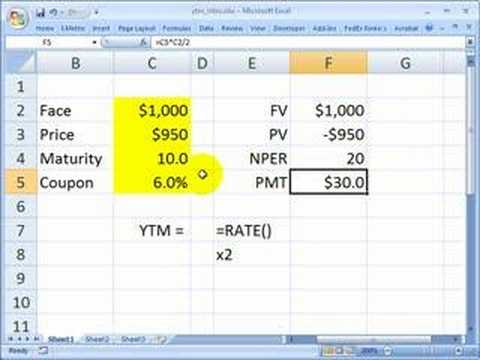

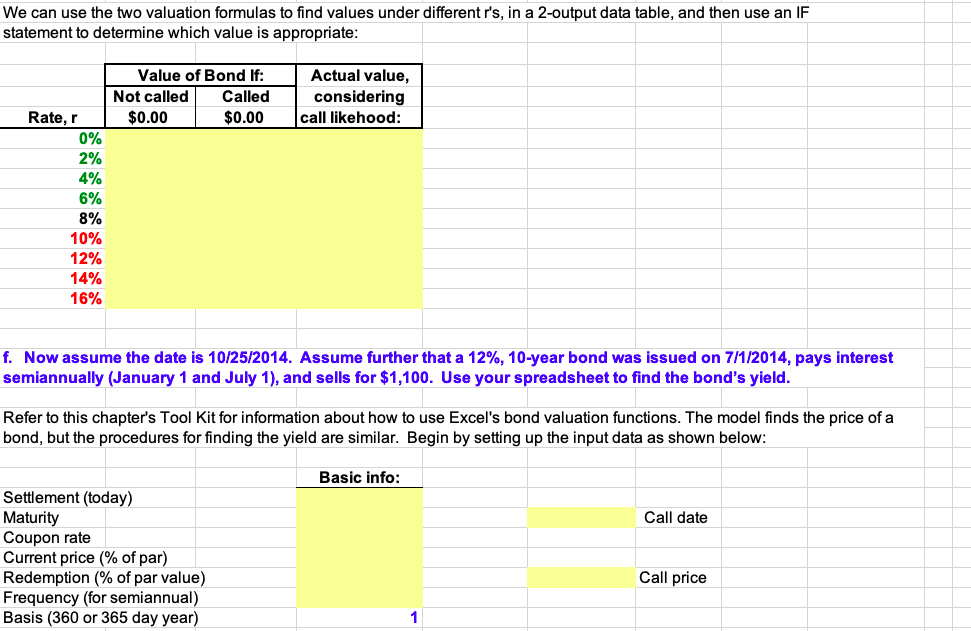

Example, and the bond has less than a year to go, the yield will be expressed in simple interest(or compounded for 276 days if that makes sense to you) (105/)*360/276 = %, on the other hand if you calculate (105/)^(365/276)1 = % You can convert the yield to XIRR in this case by ((XIRR%1)^(276/365)1)*365/276How Does Yield to Call (YTC) Work?The yield is calculated from the cash flows from the coupon payments plus the cash flow of the redemption proceeds at the time of the call Where the coupon payment refers to the total interest per year on a bond Yield to call can be mathematically derived and calculated from the formula

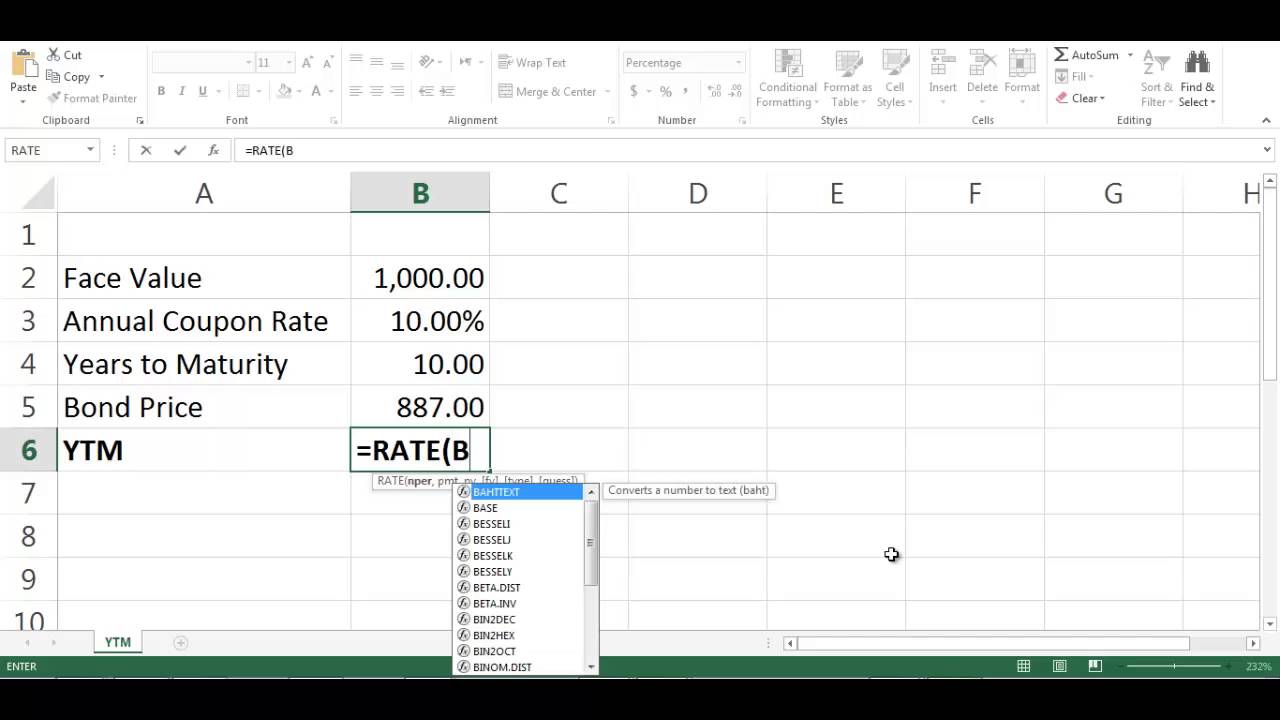

Yield To Call Ytc Definition Formula Equation Example Excel Calculator

Excel formula to calculate yield to call

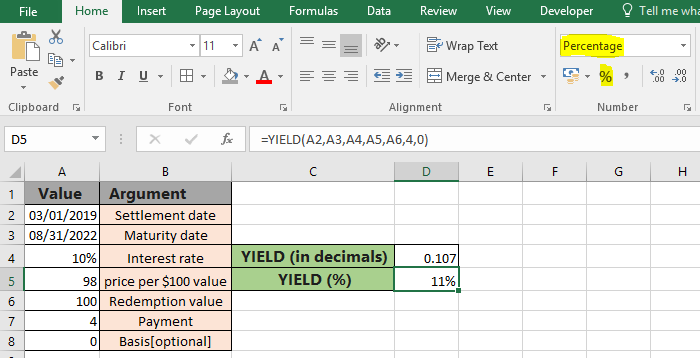

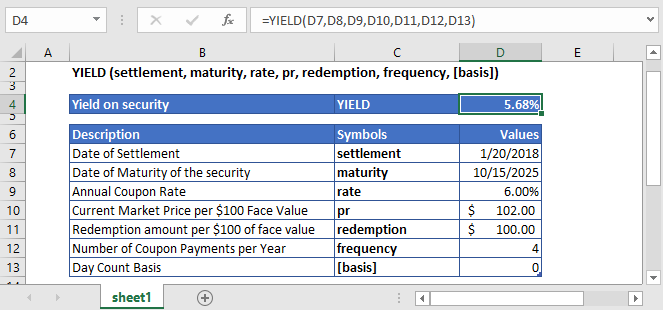

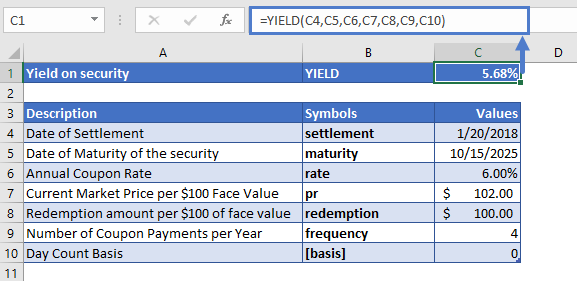

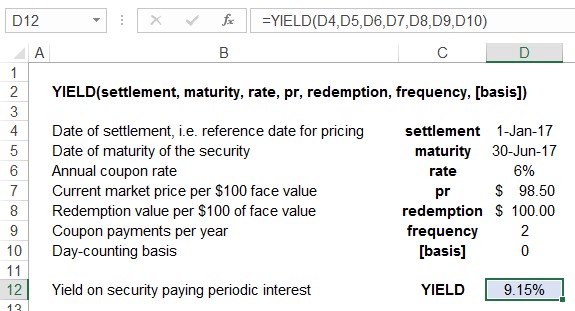

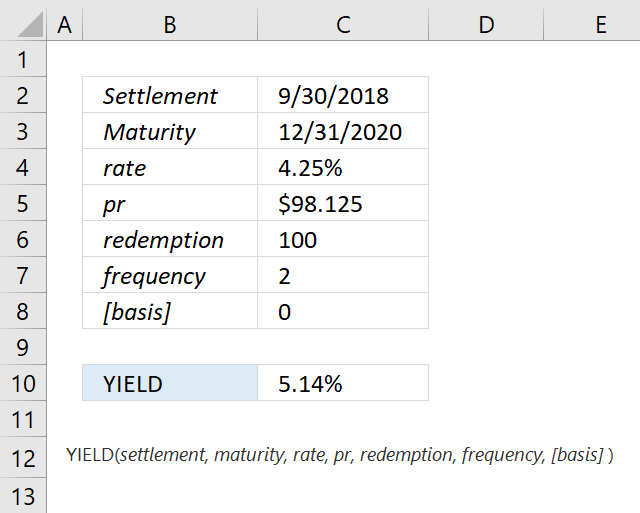

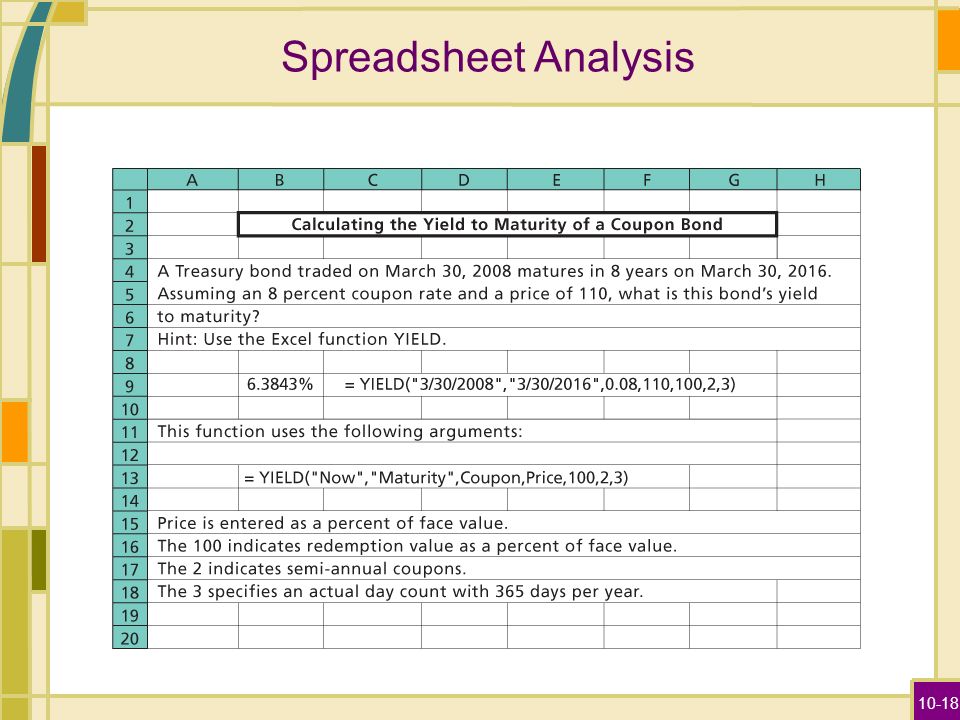

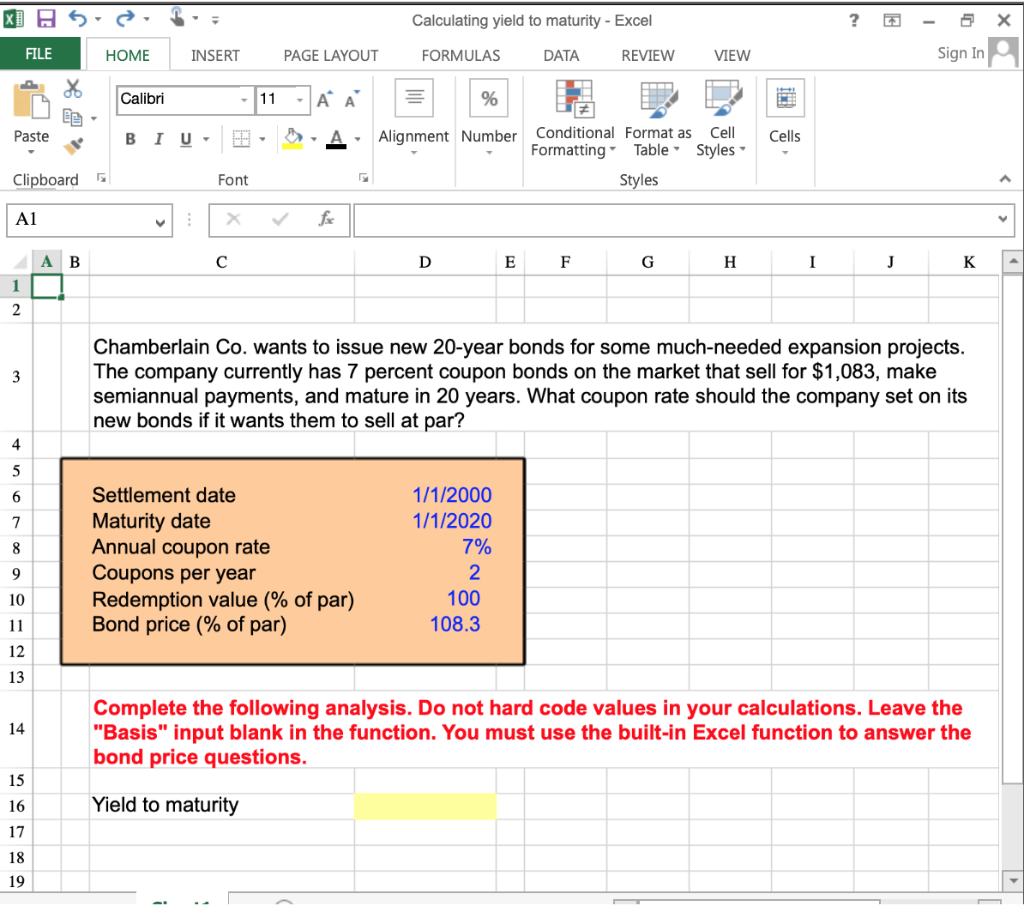

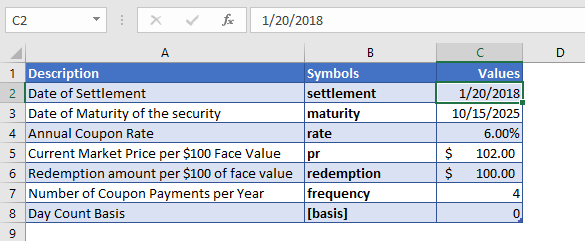

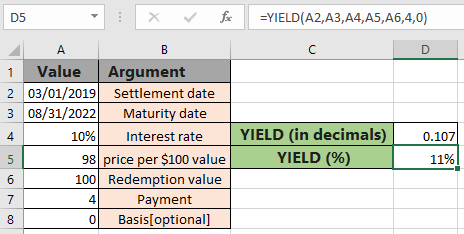

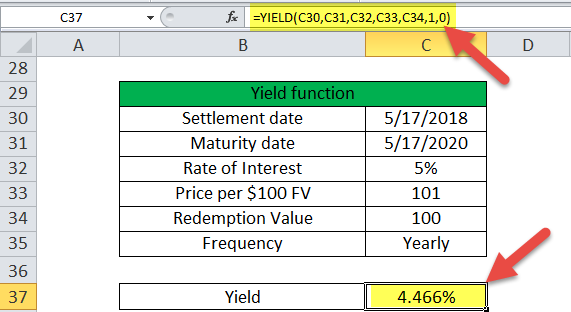

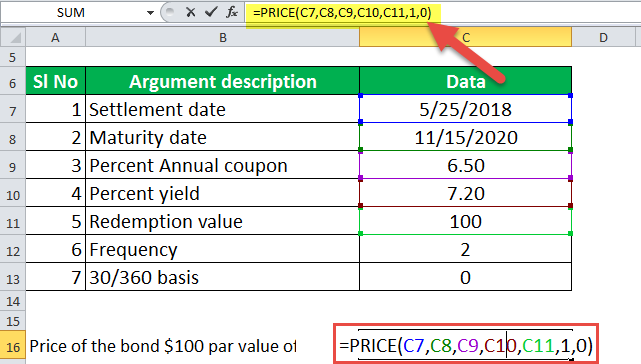

Excel formula to calculate yield to call-Yield to call is expressed as an annual percentage rate ie yield to call is equal to number of payments per year multiplied by r Using a financial calculator, yield to call can be calculated by using the IRR function Example Izmir Construction is a company engaged in construction in Turkish westThe Excel YIELD function returns the yield on a security that pays periodic interest It returns the value as a percentage Calculate the Yield of a security In this example, we calculate the yield on a security that was purchased on January , 18, with an annual interest rate of 6% Other details of the security are mentioned in the above

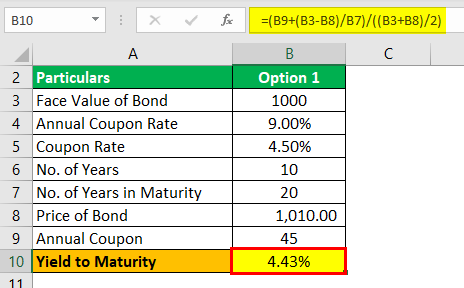

How To Calculate Yield To Maturity In Excel With Template Exceldemy

C = Coupon/interest payment F = Face value P = Price n = Years to maturity This is the most accurate formula because yield to maturity is the interest rate an investor would earn by reinvesting every coupon payment from the bond at a constant rate until the bond reaches maturity2) Using Excel's IRR Function This is an easy and straightforward way of calculating YTM in Excel You see I have just entered the future cash flows from the bond investments in a column (Payment column) and then used Excel's IRR function The formula gives us the internal rate of return for a period 375%BDS formulas gives multicells of data such as company description, index members' weightage, top holders, etc Formula =BDS(ticker, field) Example =BDS(PSI Index, indx mweight, "cols=2;rows=") For template with formulas set up, enter API > click Sample Spreadsheet > choose Tutorials > Bloomberg API

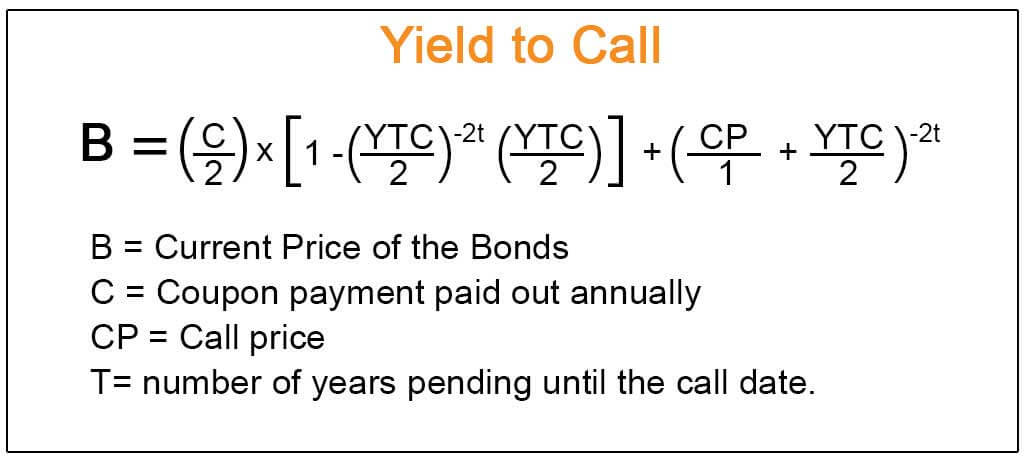

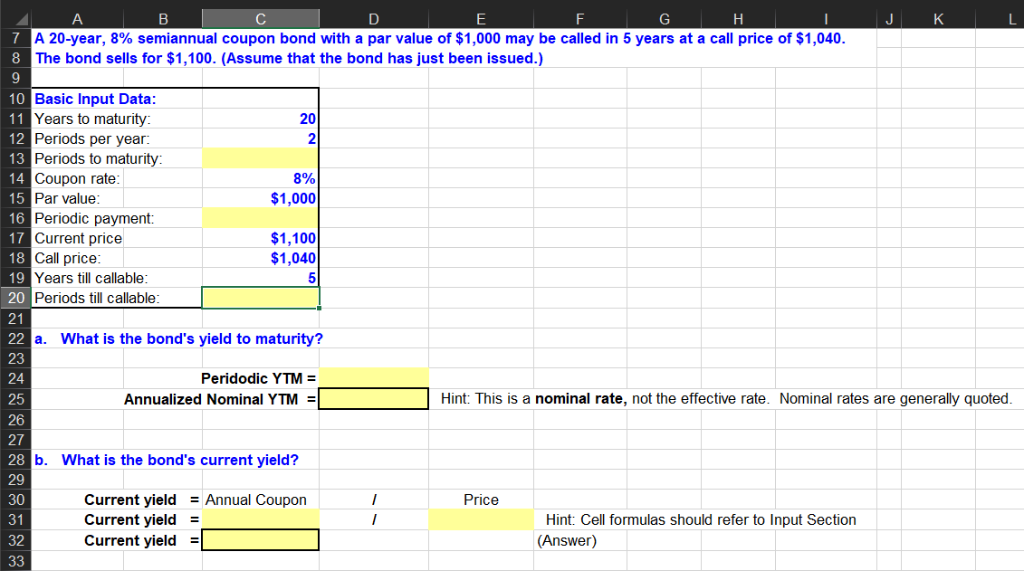

Finally, add the two types of yield interest rate and bond price for each of the possible call dates as well as the maturity dates Divide by the number of years to convert to an annual rateHow to calculate the yield to call on a callable bond using Excel and the Texas Instruments BAII calculator(Recorded with http//screencastomaticcom)The formula for yield to call is calculated through an iterative process and is not a direct formula even though it may look like one Mathematically, yield to call is calculated as Yield to Call Formula = (C/2) * {(1 ( 1 YTC/2) 2t ) / (YTC/2)} (CP/1 YTC/2) 2t )

How to Use Excel to Calculate a Bond's Yield to Call Bonds are investment vehicles that make regular coupon payments until maturity, at which time the bond's face value is paid If a bond isWhat is the math formula to proof excel calculation 3426 as my example above Alternatively, note that the yield to maturity is the IRR of the cash flows So we might use the Excel RATE, IRR or XIRR function to convince ourselves that the YIELD function is returning the correct value Here is how Yatie wrote previously Face value 100YIELD is an Excel function that returns the yield to maturity of a bond given its coupon rate, current price, principal amount and coupon payment frequency per year In the context of debt securities, yield is the return that a debtholder earns by investing in a security at its current price

Bond Yield Formula Calculator Example With Excel Template

How To Calculate Pv Of A Different Bond Type With Excel

Use the Yield Function to Calculate the Answer Type the formula "=Yield (B1,B2,,B4,B5,B6,)" into cell B8 and hit the "Enter" key The result should be percentwhich is the annual yield to maturity of this bondThe Current Yield should be 60% The Yield to Maturity should read 60%, and the Yield to Call should read 990% If the values in the bond yield calculator match the figures listed above, the formulas have been entered correctly If the values do not match, double check that the formulas have been entered correctlyHere is one sample Bond Face value 100,000 Issue march, 4, 05 Maturity march, 4, 06 Coupon 5%;

Yield To Maturity Ytm Overview Formula And Importance

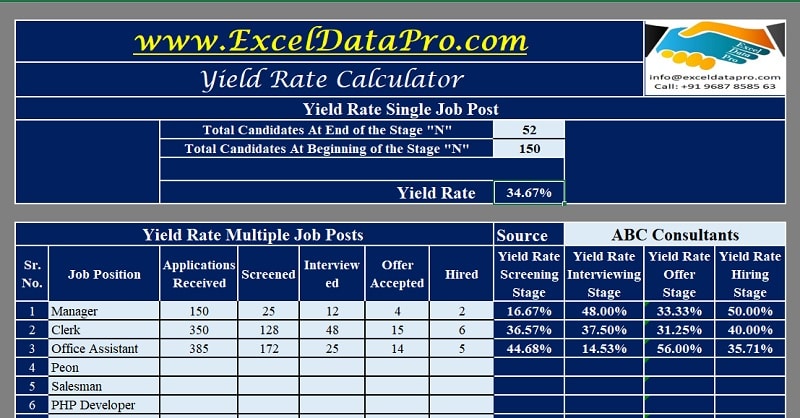

Download Yield Rate Calculator Excel Template Exceldatapro

Definition & Formula Yield to Call is a finance function or method used in the context of stock market, often abbreviated as YTC, represents the return from callable bond before its maturity, whereas, the YTM Yield to Maturity represents the rate of return percentage, if the bond is held until its maturity in the stock marketAFAIK YIELD is calculated to the date you specify as the maturity date, whether that's actually what it is or not To get yieldtocall, you use the YIELD formula with the call date instead of the maturity date and the call price instead of the value at maturity (The latter is probably par, the call price may be above par)To calculate a bond's yield to call, enter the face value (also known as "par value"), the coupon rate, the number of years to the call date, the frequency of payments, the call premium (if any), and the current price of the bond Calculating Yield to Call Example For example, you buy a bond with a $1,000 face value and 8% coupon for $900

How To Use The Yield Function In Excel

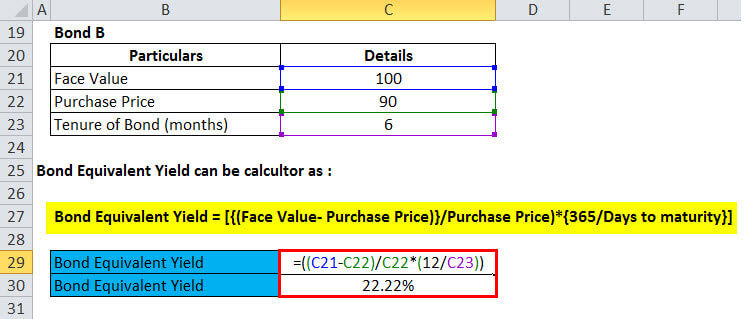

Bond Equivalent Yield Formula Calculator Excel Template

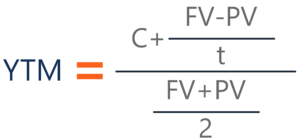

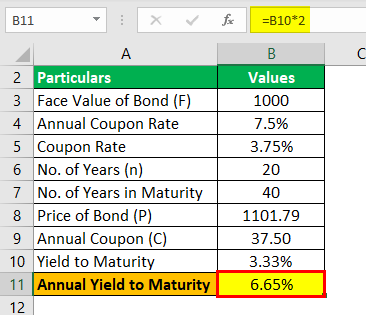

The call could happen at the bond's face value, or the issuer could pay a premium to bondholders if it decides to call its bonds early For callable bonds, knowing the coupon rate and yield toBond Yield to Call Formula The calculation for Yield to Call is very similar to Yield to Maturity When making this calculation, we assume the bond will be called away at the first opportunity Additionally, the price to call bond is usually a bit more than the face value of the bond – we use the price to call for this formula instead of theThe formula for determining approximate YTM would look like below The approximated YTM on the bond is 1853% Importance of Yield to Maturity The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different securities and the returns they can expect from each

Q Tbn And9gcswvwlf2 Gflrft2 K7itm2p95ues Q1cu4lrtkewbnunv25pxn Usqp Cau

Bond Yield Calculator

In this video, we are going to learn how to use YIELD function in excel using YIELD Formula𝐘𝐈𝐄𝐋𝐃 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧 𝐢𝐧What is the math formula to proof excel calculation 3426 as my example above Alternatively, note that the yield to maturity is the IRR of the cash flows So we might use the Excel RATE, IRR or XIRR function to convince ourselves that the YIELD function is returning the correct value Here is how Yatie wrote previously Face value 100Where the call yield is in B13 and B9 is the payment frequency (2 for semiannual) This gives us a call price of $1,, which is $ above the current price of the bond Obviously, PPG is unlikely to call the bond under these circumstances Using the Price Function

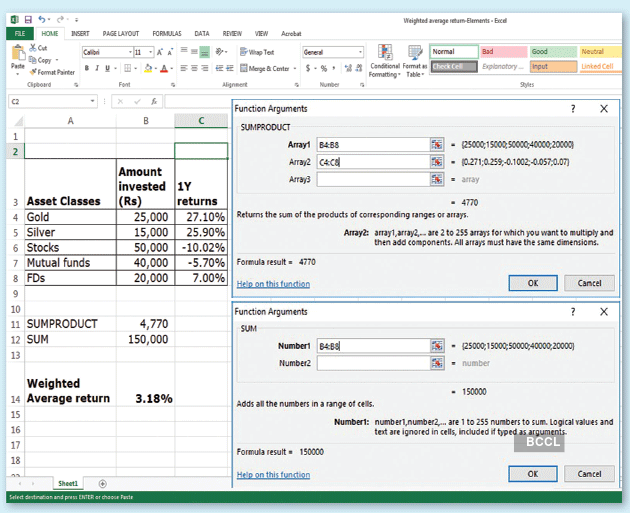

How To Calculate Weighted Average Returns Using Ms Excel The Economic Times

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Calculating the yield to call is done in the same way, except that we need to add the call premium to the redemption value, and use the next call date in place of the maturity date Enter the following function into B19 =YIELD(B6,B8,B4,B13,*(1B9),B10,B11) You should find that the YTC is 1517%Settlement June 1st 05, price 101 This gives a yield of %Click the insert function button (fx) under the formula toolbar, a dialog box will appear, type the keyword "YIELD" in the search for a function box, YIELD function will appear in select a function box Double click on the YIELD function A dialog box appears where arguments for the YIELD function needs to be filled or entered

Excel Yield Function

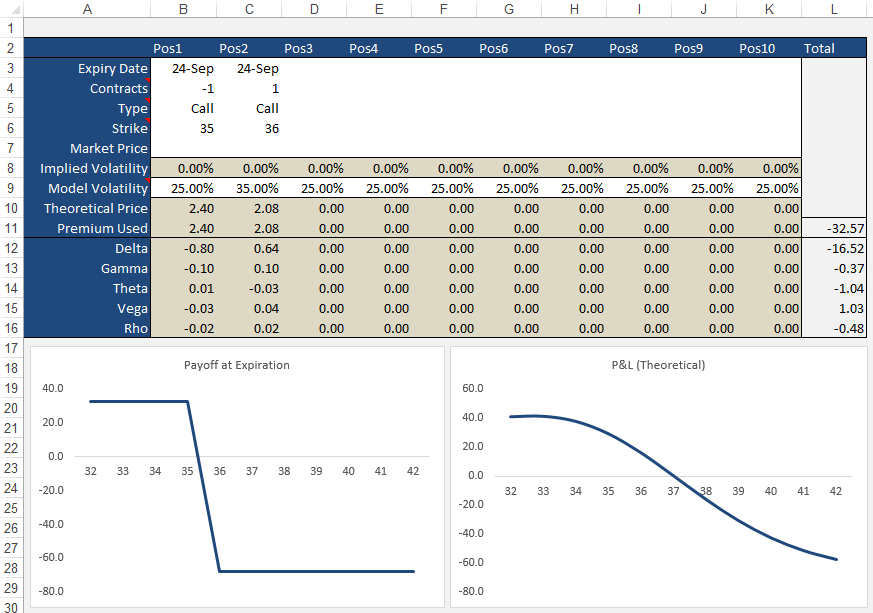

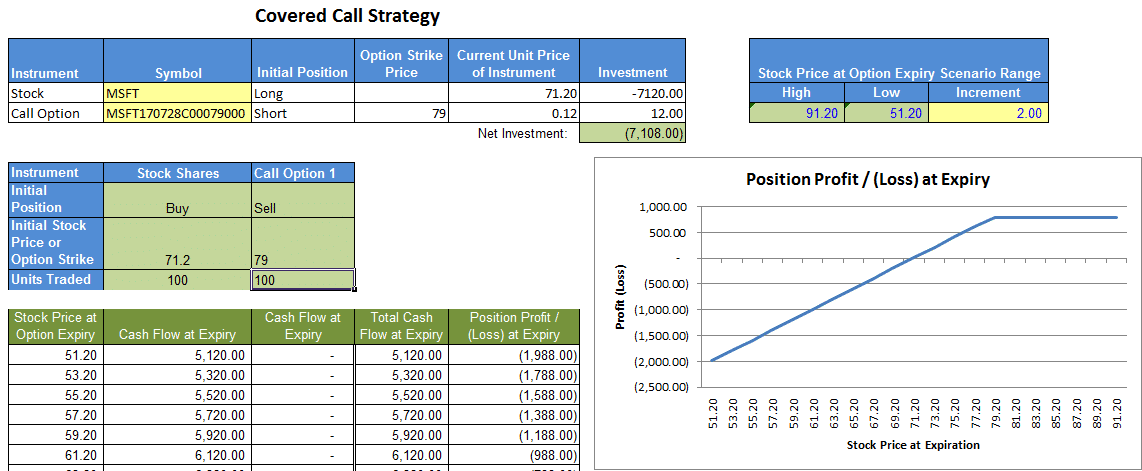

Option Pricing The Guide To Valuing Calls And Puts Toptal

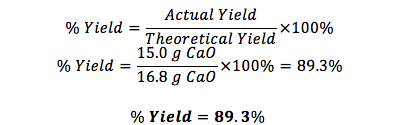

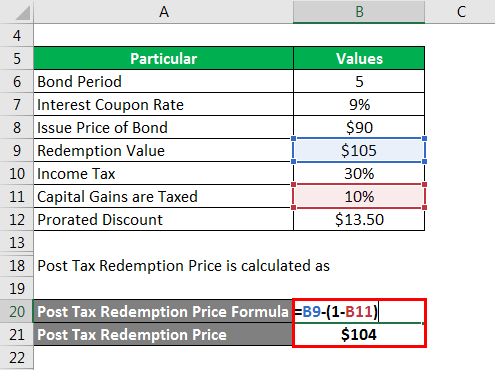

Yield Yield can be said as the total amount of return an investor earns or can be said as the return earned on his/her Investment Formula #1 YTM = n √ (Face Value/ Current Price) n – 1Finally, this spreadsheet also illustrates how to plot the US Treasury Bond Yield Curve which is used by many analysts for understanding the current conditions in the financial markets Bond Valuation Yield to Maturity The Yield to Maturity is a common yardstick that a bond investor uses to measure the value of a bondEnter the formula "=RATE(B5B4,/B4B1,B2,B1(1B6))B4" without quotes in cell to calculate the YTC In the prior example, the YTC is 872 percent In the prior example, the YTC is 872 percent

Explained How To Calculate Yields On Your Bond Investments

How To Calculate Bond Price In Excel

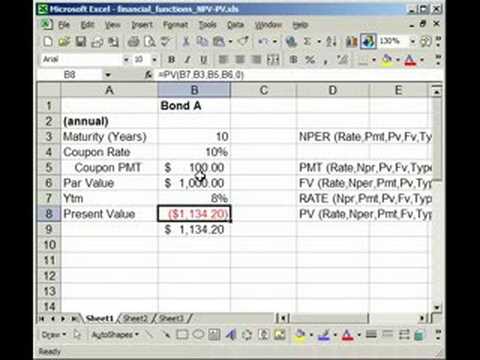

The Excel TBILLEQ function returns the bondequivalent yield for a Treasury bill, based on based on a settlement date, a maturity date, and a discount rate In the example shown, the settlement date is 5Feb19, the maturity date is 1Feb, and the discount rate is 254% The formula in F5 is =Select the cell you will place the calculated result at, type the formula =PV(B11,B12,(B10*B13),B10), and press the Enter key See screenshot Note In above formula, B11 is the interest rate, B12 is the maturity year, B10 is the face value, B10*B13 is the coupon you will get every year, and you can change them as you needVar unitSoldInNov = contextworkbookfunctionsvlookup("Wrench", range, 2, false);

Free Bond Duration And Convexity Spreadsheet

Yield To Maturity Formula Step By Step Calculation With Examples

To understand yield to call, one must first understand that the price of a bond is equal to the present value of its future cash flows, as calculated by the following formula where P = price of the bond n = number of periods C = coupon payment r = required rate of return on this investment F = principal at maturity t = time period when payment is to beBased on this formula, the yield to call cannot be solved for directly An iterative process must be used to find the yield to call, if the calculation is being done by hand Fortunately, manyHow to Calculate Yield to First Call Some bonds are callable on a date before the final maturity date A early call gives the issuer the option to retire the debt by calling in bonds Callable bonds will have a specific call date and price According to the Business Finance Online website, yield to maturity and yield

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Yield To Maturity Calculation In Excel Example

Yield Function in Excel Excel Yield Function is used to calculate on a security or a bond which pays the interest periodically, the yield is a type of financial function in excel which is available in the financial category and is an inbuilt function which takes settlement value, maturity, and rate with bond's price and redemption as an input In simple words the yield function is used to determine the bond yieldHow to Calculate Yield to First Call Some bonds are callable on a date before the final maturity date A early call gives the issuer the option to retire the debt by calling in bonds Callable bonds will have a specific call date and price According to the Business Finance Online website, yield to maturity and yieldThe Excel YIELD function returns the yield on a security that pays periodic interest It returns the value as a percentage Calculate the Yield of a security In this example, we calculate the yield on a security that was purchased on January , 18, with an annual interest rate of 6% Other details of the security are mentioned in the above

How To Use The Yield Function

Bond Price Calculator Present Value Of Future Cashflows Dqydj

Note To see how the different parts of an Excel formula works, select that part and press the F9 key You will see the value of that part of the formula Example 2 Reference individual cell of another worksheet In this example, I am pulling a row from another worksheet based on some cell values (references)Tell Excel Your Data Is Stock Data You also have the option to manually tell Excel your cell data should be converted into the stock data type Simply select the cells that contain the stock names/ticker symbols and navigate to the Data tab in the Excel Ribbon Next click the Stocks button within the Data Types groupReturn contextsync() then(function { consolelog(' Number of wrenches sold in November = ' unitSoldInNovvalue);

Bond Pricing Valuation Formulas And Functions In Excel Youtube

Calculating Bond S Yield To Maturity Using Excel Youtube

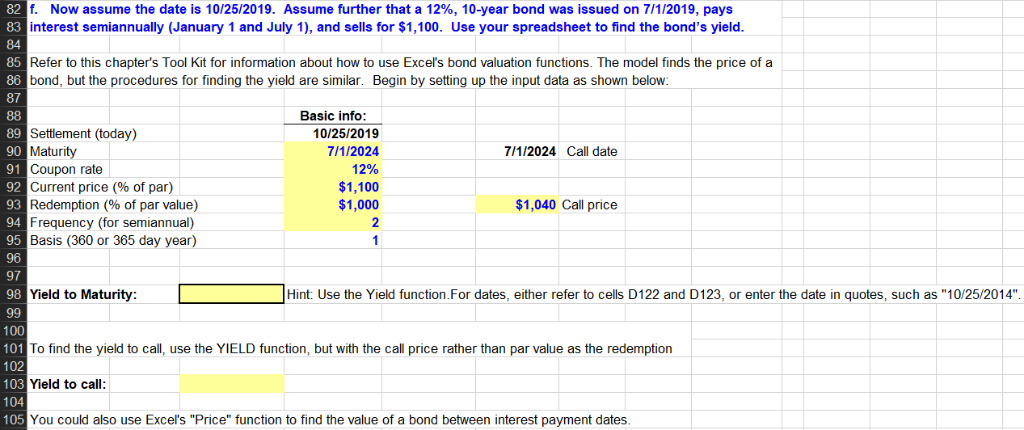

Yield To Call Excel View Answers I am trying to do some bond analysis on a spreadsheet There are functions I am trying to do a very simple copy and paste of a simple formula in Excel 07 and nothing seems to be working Excel will not let me copy and paste a formula and will only paste the value into to workbook For instance, if IThe only unusual thing is that we use the Treasury yield plus the spread The formula is =PRICE(B10,B11,B6,B13,B5/10,B9,0)*10 And that, of course, gives exactly the same result as the NPV function ($1,) Using the PV Function Finally, we can use Excel's PV function to find the call price of the bondDSR = number of days from the settlement date to the redemption date E = number of days in the coupon period If there is more than one coupon period until redemption, YIELD is calculated through a hundred iterations The resolution uses the Newton method, based on the formula used for the function PRICE

10 Bond Prices And Yields Ppt Video Online Download

How To Calculate Yield For A Callable Bond The Motley Fool

Yield is different from the rate of return, as the return is the gain already earned, while yield is the prospective return Formula = YIELD(settlement, maturity, rate, pr, redemption, frequency, basis) This function uses the following arguments Settlement (required argument) – This is the settlement date of the security It is a date after the security is traded to the buyer that is after the issue dateTo calculate the current yield of a bond in Microsoft Excel, enter the bond value, the coupon rate, and the bond price into adjacent cells (eg, A1 through A3) In cell , enter the formula "= A1Hi, Can someone explain why in very easy samples XIRR gives a slightly different (and wrong) result than YIELD?

Yield To Call Ytc Calculator

Excel Yield Function

Formula =BDH(security, field(s), start date, end date) Example =BDH("SIA SP Equity","px_last", "12/30/08", "12/30/09") Bloomberg Data Set (BDS) BDS formulas gives multicells of data such as company description, index members' weightage, top holders, etc Formula =BDS(ticker, field) Example =BDS(PSI Index, indx mweight, "cols=2;rows=")Yield to call is expressed as an annual percentage rate ie yield to call is equal to number of payments per year multiplied by r Using a financial calculator, yield to call can be calculated by using the IRR function Example Izmir Construction is a company engaged in construction in Turkish westNote To see how the different parts of an Excel formula works, select that part and press the F9 key You will see the value of that part of the formula Example 2 Reference individual cell of another worksheet In this example, I am pulling a row from another worksheet based on some cell values (references)

How To Use The Excel Duration Function Exceljet

Yield To Call Definition Formula How To Calculate Yield To Call Ytc

Excelrun(function (context) { var range = contextworkbookworksheetsgetItem("Sheet1")getRange("A1D4");Step 1, Type the column heading and data labels Beginning with cell A1, type the following text into cells A1 through A8 Bond Yield Data, Face Value, Annual Coupon Rate, Annual Required Return, Years to Maturity, Years to Call, Call Premium and Payment Frequency Skipping over cell , type "Value of Bond" in cell A10Step 2, Format the text in column A Move the mouse pointer over the line separating columns A and B, just above the Bond Yield Data column heading Click and drag the lineThe YIELD function returns the yield on a security that pays periodic interest In the example shown, the formula in F6 is = YIELD( C9, C10, C7, F5, C6, C12, C13) with these inputs, the YIELD function returns 008 which, or 800% when formatted with the percentage number format

Yield To Maturity Formula Step By Step Calculation With Examples

Bond Duration Formula Excel Example

Bond Yield Formula Calculator Example With Excel Template

How To Calculate Yield To Maturity In Excel With Template Exceldemy

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Learn To Calculate Yield To Maturity In Ms Excel

Bonds Ytm And Ytc Calculation Of Yield To Maturity And Yield To Call Youtube

Bond Equivalent Yield Formula Calculator Excel Template

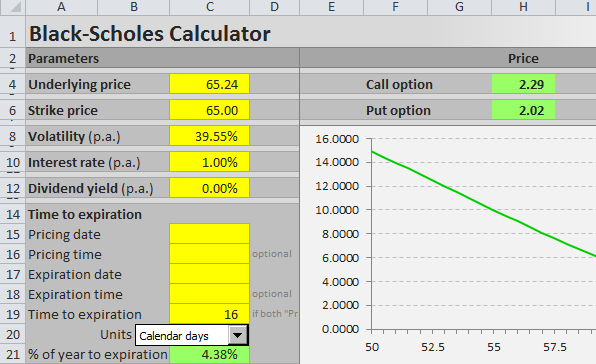

Black Scholes Option Calculator

How To Use The Excel Yield Function Exceljet

Best Excel Tutorial How To Calculate Yield In Excel

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

How To Excel At Options Valuation

Please Solve Using Excel Please Show Excel Formul Chegg Com

Yield To Maturity Formula Step By Step Calculation With Examples

Solved Calculating Yield To Maturity Excel Home Insert Chegg Com

How To Calculate The Yield To Maturity Of A Bond Or Cd With Excel Youtube

Finding Yield To Maturity Using Excel Youtube

How To Calculate Pv Of A Different Bond Type With Excel

Option Pricing In Excel With Marketxls Download Option Chains Real Time Prices More

An Introduction To Bonds Bond Valuation Bond Pricing

Yield Function Calc Bond Yield Excel Vba G Sheets Automate Excel

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

Calculate Implied Volatility In Excel And Vba Through Step By Step

Yield Function Formula Examples Calculate Yield In Excel

Vba To Calculate Yield To Maturity Of A Bond

How To Calculate Bond Price In Excel

How To Calculate Yield To Maturity In Excel With Template Exceldemy

1

Calculating Bond Yield To Call Using Excel And Baii Calc Youtube

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Ytm Formula Excel

Yield To Call Ytc Definition Formula Equation Example Excel Calculator

Preface

Make Whole Call Provisions In Excel Tvmcalcs Com

How To Use The Yield Function In Excel

Learn To Use The Excel Yield Function Properly Finance Homework Help

Yield Formula Excel Example

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Best Excel Tutorial How To Calculate Yield In Excel

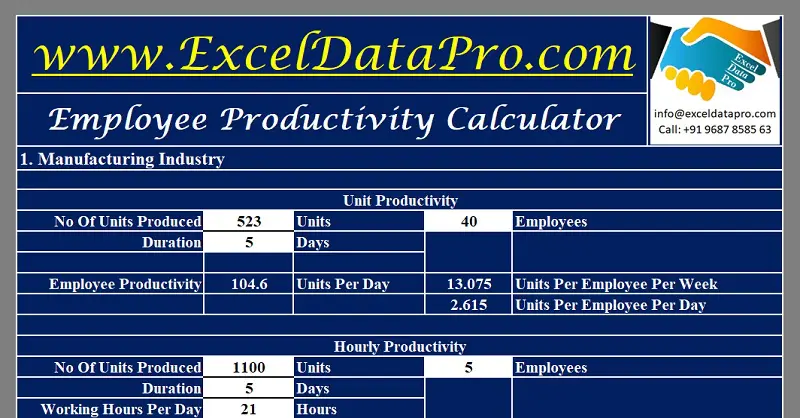

Download Employee Productivity Calculator Excel Template Exceldatapro

Yield To Maturity Formula Step By Step Calculation With Examples

Yield Function In Excel Calculate Yield In Excel With Examples

Learn To Use The Excel Yield Function Properly Finance Homework Help

Yield To Maturity Approximate Formula With Calculator

Free Bond Valuation Yield To Maturity Spreadsheet

Yield Formula Excel Example

How To Calculate Yield To Maturity 9 Steps With Pictures

Yield To Maturity Ytm Overview Formula And Importance

Q Tbn And9gcspsw0gvryuir4hbunmr9ryyqtt9uvaiwo4js Vmypouh4p4lqk Usqp Cau

Yield To Maturity Ytm Calculator

Make Whole Call Provisions In Excel Tvmcalcs Com

Boeing Corporation Has Just Issued A Callable At Par Three Year 5 4 Coupon Bond With Semi Annual Coupon Homeworklib

Calculating Implied Volatility In Excel

What Is Yield To Maturity How To Calculate It Scripbox

How To Calculate Yield To Maturity 9 Steps With Pictures

Yield To Maturity Ytm Definition Formula And Example

Negative Interest Rates And Negative Yields On Bonds What They Mean

How To Use Excel Outlook Crm For Sales Marketing

How To Calculate Bond Price In Excel

Best Excel Tutorial How To Calculate Yield In Excel

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Frm How To Get Yield To Maturity Ytm With Excel Ti Ba Ii Youtube

How To Calculate Yield For A Callable Bond The Motley Fool

Black Scholes Excel Formulas And How To Create A Simple Option Pricing Spreadsheet Macroption

Solved Please Only Use Excel Formulas To Solve And Show T Chegg Com

Solved A Year 8 Semiannual Coupon Bond With A Par Va Chegg Com

Best Excel Tutorial How To Calculate Yield In Excel

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

How To Calculate Bond Yield In Excel 7 Steps With Pictures

3 Ways To Bootstrap Spot Rates For The Treasury Yield Curve Excel Cfo

Bond Calculator Excel For 21 Printable And Downloadable Gust

Duration And Convexity With Illustrations And Formulas

Yield To Maturity Components And Examples Of Yield To Maturity

Learn To Calculate Yield To Maturity In Ms Excel

コメント

コメントを投稿